Age

Thursday 29/1/2009 Page: 3

SENIOR state bureaucrats have attacked the Brumby Government's subsidy plan for household solar panels, saying it won't work. In a confidential memo, high-ranking officers of Victoria's Department of Sustainability and Environment have told Environment Minister Gavin Jennings that the proposed scheme would do nothing for photovoltaic (PV) solar panel numbers in Victoria. "The uptake of the PV systems will be no greater than ... would have occurred under the status quo," says the terse memo by officers, including environmental policy and climate change executive director Fiona Williams.

The memo is a response to last year's cabinet decision backing a limited subsidy system for households that install small solar systems, known as a "net feed-in tariff". The memo forecasts that under the Government model, only 10,000 solar systems would be installed by 2020, the same as expected with no subsidy. This compares to 70,000 systems under a more ambitious scheme rejected by the Government.

The memo undermines figures used by Energy Minister Peter Batchelor to reject the more ambitious scheme. known as a "gross feed-in tariff". Mr Batchelor argued that such a scheme would cost households $100 a year, making it too expensive and unfair to low income people without solar panels. But the department memo puts the real cost per household at a maximum of $7 a year.

The figures in the memo are based on modelling by consultants McLennan Magasanik Associates. The modelling was commissioned by Mr Batchelor's Department of Primary Industries but never released. Under the more ambitious model, households, businesses, farmers and community groups would receive a premium payment, well above the standard electricity rate, for all renewable power they generate, including what they use themselves.

By contrast, the scheme chosen by the Government will provide premium payments only to households, and only for surplus power fed back into the electricity grid after they have used what they need. The Age has repeatedly asked Mr Batchelor if he stands by his figures and how he arrived at them. He has refused to answer questions.

Last night a spokeswoman, Emma Tyiner, restated the view that a gross scheme would be unfair. "The Brumby Government has developed a net feed-in tariff that will give generous returns to people who install solar panels without imposing unfair costs on those who cannot install them," she said.

Revelations that the proposed scheme may be ineffective, and that the costs of the alternative gross scheme had been exaggerated, have led to calls for Labor to rethink its plans, to be detailed in Parliament soon.

The Government's own Sustainability Commissioner, Ian McPhail, is among those backing the alternative gross scheme. "My personal view is to encourage the Government to reconsider its policy on the net feed-in tariff, which provides unintentional protection for the existing coal-fired generators," Mr McPhail said.

Environment Victoria campaigns director Mark Wakeham, said it was ironic that doubts about the solar scheme had surfaced amid a heatwave. "Instead of putting our powerful sun to work, the Brumby Government has caved into polluter interests by continuing with a business-as-usual approach," he said.

Welcome to the Gippsland Friends of Future Generations weblog. GFFG supports alternative energy development and clean energy generation to help combat anthropogenic climate change. The geography of South Gippsland in Victoria, covering Yarram, Wilsons Promontory, Wonthaggi and Phillip Island, is suited to wind powered electricity generation - this weblog provides accurate, objective, up-to-date news items, information and opinions supporting renewable energy for a clean, sustainable future.

Friday, 30 January 2009

Thursday, 29 January 2009

Solar demand soars despite delays

Canberra Times

Wednesday 28/1/2009 Page: 4

ActewAGL has received a surge of requests for solar energy connection despite lengthy delays and confusion about how to calculate rebates. The ACT's new solar feed-in tariff has been brought forward from July to March 1 this year after lobbying from the ACT Greens. The Greens say the tariff will slash the time it takes Canberrans to recoup the costs of connecting solar energy from 30 to 10 years. Applications for connections over the past year equalled the number received in the previous five years, with a bigger rise in demand expected after March.

ActewAGL has received a surge of requests for solar energy connection despite lengthy delays and confusion about how to calculate rebates. The ACT's new solar feed-in tariff has been brought forward from July to March 1 this year after lobbying from the ACT Greens. The Greens say the tariff will slash the time it takes Canberrans to recoup the costs of connecting solar energy from 30 to 10 years. Applications for connections over the past year equalled the number received in the previous five years, with a bigger rise in demand expected after March.

Environment Minister Simon Corbell says amendments aimed at clearing tip ambiguities in the tariff law won't stop it being Australia's most generous. Daffy resident Tim Roberts invested $40,000 in a new solar system, calculating it would take eight to 12 years to recoup his costs, only to be told by an industry source the quoted rebate of 3.88 times the normal rate of electricity was under review.

"I thought the Government was doing the right thing [introducing the scheme] and showing leadership," he said. ''But they've been holding meetings with industry groups and changing the goal posts." Mr Corbell said he would announce changes to clear tip technicalities in the legislation when the Legislative Assembly resumed sitting next month.

Rebates would still be calculated at 3.88 times the price of electricity. He would also announce how many cents per kW-hours people would be paid for the power they generated. Hilton Fletcher, of installation company Green Frog Solar and Electrical, said the law needed fine tuning to give customers a clearer understanding of the rebate. He said the 3.88 multiplier, adopted by former Labor backbencher Mick Gentleman, who introduced the legislation, didn't mean mach to consumers.

He expected the Government would set a price of between 50c and 60c per kW-hour. "Obviously there would have been some lobbying from energy companies as well, not wanting to pay too much for the energy they have to buy, but it makes sense to its to simplify it a bit." Greens environment spokesman Shane Rattenbury said the law needed tidying tip, but he was unaware of any move to change the 3.88 multiplier. "I think the 3.88 is an appropriate level, it's a level which is encouraging people to get involved.

It is the one that's out there and people have made their investment decisions on it." Solartec Renewables, one of the ACT's largest solar energy companies, said ActewAGL had reduced metering staff, causing delays of two to three months for connections to the grid. Co-director Phil May said he'd been warned by ActewAGL to stop helping prepare wiring for connections, otherwise he could be charged with meter tampering.

"It's a pretty big issue here. You may spend $30,000 or $40,000 or $50,000 on a solar energy system you're not allowed to torn on," he said. "It's like baying a new car and you're not allowed to drive it for three months. It's just incredible." ActewAGL denies cutting staff. The waiting time for connections was about four weeks, which the utility aimed to reduce to two weeks.

Wednesday 28/1/2009 Page: 4

ActewAGL has received a surge of requests for solar energy connection despite lengthy delays and confusion about how to calculate rebates. The ACT's new solar feed-in tariff has been brought forward from July to March 1 this year after lobbying from the ACT Greens. The Greens say the tariff will slash the time it takes Canberrans to recoup the costs of connecting solar energy from 30 to 10 years. Applications for connections over the past year equalled the number received in the previous five years, with a bigger rise in demand expected after March.

ActewAGL has received a surge of requests for solar energy connection despite lengthy delays and confusion about how to calculate rebates. The ACT's new solar feed-in tariff has been brought forward from July to March 1 this year after lobbying from the ACT Greens. The Greens say the tariff will slash the time it takes Canberrans to recoup the costs of connecting solar energy from 30 to 10 years. Applications for connections over the past year equalled the number received in the previous five years, with a bigger rise in demand expected after March.Environment Minister Simon Corbell says amendments aimed at clearing tip ambiguities in the tariff law won't stop it being Australia's most generous. Daffy resident Tim Roberts invested $40,000 in a new solar system, calculating it would take eight to 12 years to recoup his costs, only to be told by an industry source the quoted rebate of 3.88 times the normal rate of electricity was under review.

"I thought the Government was doing the right thing [introducing the scheme] and showing leadership," he said. ''But they've been holding meetings with industry groups and changing the goal posts." Mr Corbell said he would announce changes to clear tip technicalities in the legislation when the Legislative Assembly resumed sitting next month.

Rebates would still be calculated at 3.88 times the price of electricity. He would also announce how many cents per kW-hours people would be paid for the power they generated. Hilton Fletcher, of installation company Green Frog Solar and Electrical, said the law needed fine tuning to give customers a clearer understanding of the rebate. He said the 3.88 multiplier, adopted by former Labor backbencher Mick Gentleman, who introduced the legislation, didn't mean mach to consumers.

He expected the Government would set a price of between 50c and 60c per kW-hour. "Obviously there would have been some lobbying from energy companies as well, not wanting to pay too much for the energy they have to buy, but it makes sense to its to simplify it a bit." Greens environment spokesman Shane Rattenbury said the law needed tidying tip, but he was unaware of any move to change the 3.88 multiplier. "I think the 3.88 is an appropriate level, it's a level which is encouraging people to get involved.

It is the one that's out there and people have made their investment decisions on it." Solartec Renewables, one of the ACT's largest solar energy companies, said ActewAGL had reduced metering staff, causing delays of two to three months for connections to the grid. Co-director Phil May said he'd been warned by ActewAGL to stop helping prepare wiring for connections, otherwise he could be charged with meter tampering.

"It's a pretty big issue here. You may spend $30,000 or $40,000 or $50,000 on a solar energy system you're not allowed to torn on," he said. "It's like baying a new car and you're not allowed to drive it for three months. It's just incredible." ActewAGL denies cutting staff. The waiting time for connections was about four weeks, which the utility aimed to reduce to two weeks.

Delays in solar cash

Daily Telegraph

Wednesday 28/1/2009 Page: 13

A FEDERAL Government scheme to promote solar energy by offering rebates to homeowners is being marred by long delays, the industry claims. solar energy installers said yesterday was now taking almost six months before money was approved under the Solar Homes and Communities Plan. When the scheme promoting the alternative energy was introduced, home owners were told it would take only 12 weeks to get their rebates, now of up to $8000.

Solar installers have been delaying billing their customers until they get their rebate, but now they face cash flow problems as customers wait first for approval to fit solar energy panels, then for verification of the installation. "The whole process has just blown out, for it to take 20 weeks is ridiculous," said Modern Solar CEO Laurie Mallia.

Wednesday 28/1/2009 Page: 13

A FEDERAL Government scheme to promote solar energy by offering rebates to homeowners is being marred by long delays, the industry claims. solar energy installers said yesterday was now taking almost six months before money was approved under the Solar Homes and Communities Plan. When the scheme promoting the alternative energy was introduced, home owners were told it would take only 12 weeks to get their rebates, now of up to $8000.

Solar installers have been delaying billing their customers until they get their rebate, but now they face cash flow problems as customers wait first for approval to fit solar energy panels, then for verification of the installation. "The whole process has just blown out, for it to take 20 weeks is ridiculous," said Modern Solar CEO Laurie Mallia.

No way to reach Rudd's target

Australian

Wednesday 28/1/2009 Page: 12

Significant reductions in emissions are all but impossible by 2020, warns Martin Nicholson

HERE may be some cause for alarm for those who are looking for big cuts in carbon emissions by 2020.

The results of a recent Australian study lead to a worrying conclusion that spending a huge $65 billion on low-emission power-generation technologies will give an 8% rise in emissions from electricity generation by 2020, not the 5% reduction that the Government wants. No cuts in power emissions will make it very difficult to make big cuts in total emissions by 2020, as electricity generation contributes almost 40% of emissions.

The Australian Academy of Technological Sciences and Engineering, a group of scientists and engineers that promotes the development of new and existing technology, has turned its collective mind to the future of electricity generation. In particular, it has considered how the government's projected reductions in carbon emissions might be achieved. This analysis of a range of electricity generation scenarios has been released in an important study, Energy Technology for Climate Change Accelerating the Technology Response.

The key finding of the report is a need for government and industry to invest about $6 billion by 2020 on research, development and demonstration of new power generation technologies. Installing the technologies by 2050 would need capital investment of about $250 billion. ATSE considered a scenario for electricity generation in 2020 that uses 20% low-carbon technologies.

This scenario is hypothetical (not a prediction) but takes into account an assessment of the state of the technologies. The low-carbon technologies include biomass, solar, wind, wave, geothermal and carbon capture and storage with a balanced split between them. The installation cost of these technologies, including some additional gas generation, is $65 billion over the next 12 years, an average of more than $5 billion a year.

The net effect of this investment is to increase carbon emissions by 8% from 2000 levels. This is a considerable improvement on the 31% increase that would happen with business-as-usual but the result is of great concern when our government wants to reduce total emissions by at least 5%, and an even greater concern for those that want the reduction to be more like 25%. Maybe the academy was too conservative with its 20% low-carbon technologies? Hardly.

The scenario requires an increase in wind energy of more than 1200% in 12 years and an increase from practically zero solar to 6% of total electricity supply over the same period. It also includes a big contribution from the yet to be commercially proven technologies such as wave and geothermal. Gas generated power would also need to increase (by 40%) and coal-CCS would need to be in production in three large power stations.

Maybe they didn't include savings from energy efficiency? The scenario expects a 20% increase in energy demand by 2020. During the same period the Australian Bureau of Statistics also expects the population to increase by 20%, so possibly the expected scenario includes no net efficiency savings or demand reduction. Could a reduction in electricity demand fix the problem? Based on the scenario modelling, reducing the demand growth rate from 1.4% per year to 0.8% a year will reduce emissions growth to zero. On past history of trying to generate demand reduction this may be a tall order and zero growth in emissions isn't what we are looking for.

So where do we go from here? We need to get a quick breakthrough in low-carbon technology (probably not likely to be quick enough), increase the 20% low-carbon target (this target is already looking like a stretch, and is very expensive) or significantly reduce electricity demand further if we have any hope of getting even the "soft" reduction of 5% by 2020. The challenge will be to do all that without greatly affecting the economy and society.

An alternative would be to recognise that even a 5% reduction in electricity generation emissions is not going to happen by 2020. In the meantime, as the academy recommends, we should spend a significant amount more on low-carbon technology research. And maybe start to plan that first nuclear energy station.

Martin Nicholson is the author of Energy in a Changing Climate.

Wednesday 28/1/2009 Page: 12

Significant reductions in emissions are all but impossible by 2020, warns Martin Nicholson

HERE may be some cause for alarm for those who are looking for big cuts in carbon emissions by 2020.

The results of a recent Australian study lead to a worrying conclusion that spending a huge $65 billion on low-emission power-generation technologies will give an 8% rise in emissions from electricity generation by 2020, not the 5% reduction that the Government wants. No cuts in power emissions will make it very difficult to make big cuts in total emissions by 2020, as electricity generation contributes almost 40% of emissions.

The Australian Academy of Technological Sciences and Engineering, a group of scientists and engineers that promotes the development of new and existing technology, has turned its collective mind to the future of electricity generation. In particular, it has considered how the government's projected reductions in carbon emissions might be achieved. This analysis of a range of electricity generation scenarios has been released in an important study, Energy Technology for Climate Change Accelerating the Technology Response.

The key finding of the report is a need for government and industry to invest about $6 billion by 2020 on research, development and demonstration of new power generation technologies. Installing the technologies by 2050 would need capital investment of about $250 billion. ATSE considered a scenario for electricity generation in 2020 that uses 20% low-carbon technologies.

This scenario is hypothetical (not a prediction) but takes into account an assessment of the state of the technologies. The low-carbon technologies include biomass, solar, wind, wave, geothermal and carbon capture and storage with a balanced split between them. The installation cost of these technologies, including some additional gas generation, is $65 billion over the next 12 years, an average of more than $5 billion a year.

The net effect of this investment is to increase carbon emissions by 8% from 2000 levels. This is a considerable improvement on the 31% increase that would happen with business-as-usual but the result is of great concern when our government wants to reduce total emissions by at least 5%, and an even greater concern for those that want the reduction to be more like 25%. Maybe the academy was too conservative with its 20% low-carbon technologies? Hardly.

The scenario requires an increase in wind energy of more than 1200% in 12 years and an increase from practically zero solar to 6% of total electricity supply over the same period. It also includes a big contribution from the yet to be commercially proven technologies such as wave and geothermal. Gas generated power would also need to increase (by 40%) and coal-CCS would need to be in production in three large power stations.

Maybe they didn't include savings from energy efficiency? The scenario expects a 20% increase in energy demand by 2020. During the same period the Australian Bureau of Statistics also expects the population to increase by 20%, so possibly the expected scenario includes no net efficiency savings or demand reduction. Could a reduction in electricity demand fix the problem? Based on the scenario modelling, reducing the demand growth rate from 1.4% per year to 0.8% a year will reduce emissions growth to zero. On past history of trying to generate demand reduction this may be a tall order and zero growth in emissions isn't what we are looking for.

So where do we go from here? We need to get a quick breakthrough in low-carbon technology (probably not likely to be quick enough), increase the 20% low-carbon target (this target is already looking like a stretch, and is very expensive) or significantly reduce electricity demand further if we have any hope of getting even the "soft" reduction of 5% by 2020. The challenge will be to do all that without greatly affecting the economy and society.

An alternative would be to recognise that even a 5% reduction in electricity generation emissions is not going to happen by 2020. In the meantime, as the academy recommends, we should spend a significant amount more on low-carbon technology research. And maybe start to plan that first nuclear energy station.

Martin Nicholson is the author of Energy in a Changing Climate.

Solar scheme advice ignored

Age

Wednesday 28/1/2009 Page: 1

AN AMBITIOUS solar energy subsidy system - rejected as too expensive and "unfair" by the Brumby Government - would have cost Victorian households no more than 70 cents a week, according to confidential advice obtained by The Age. The system has been credited with triggering a multibillion dollar solar energy boom in Germany and has been adopted in about 40 other countries.

But despite repeated urgings from bureaucrats and government agencies to have the system adopted in Victoria as an affordable way of boosting renewable energy production, the Government rejected it in favour of a much less ambitious alternative. According to a leaked cabinet committee submission from the Department of Sustainability and Environment, the so called "gross feed-in" solar subsidy scheme would have cost households just $18 a year, or 35 cents a week, increasing electricity bills by just 2%.

The department's submission, seen by The Age, says the system would "provide the required momentum to create a thriving solar industry in Victoria". Instead, the Government chose to take the advice of one department, Primary Industries and Energy, for a cheaper model known as a "net feed-in tariff" - despite its costings showing the more generous scheme likely to cost Victorian households $37 a year or 70 cents a week.

The adopted scheme - to be detailed in Parliament within weeks - is widely viewed by academic and industry experts as unlikely to encourage a broad take-up of solar panels. Well-placed sources across government have told The Age that, until shortly before last year's cabinet decision, Premier John Brumby had been relaxed about the most ambitious scheme, and that it was also strongly backed by Environment Minister Gavin Jennings.

Then, after months of studies, consultant reports, debate and advice, Energy Minister Peter Batchelor produced his own last-minute figures, claiming the cost at $100 a year for households, or 10% on average power bills. He said it would be unfair to impose such a burden on low income households. Mr Batchelor told a public accounts committee hearing that the level of cross-subsidy from non-solar households to those with solar was unsupportable.

The "gross feed-in" system has adopted by more than 40 countries and is credited with fuelling Germany's solar industry, which employs 57,000 people and exports solar products worth $2 billion euros a year.

Under the German system, households, businesses, farmers and community groups receive subsidies for all the renewable power they generate, including what they use themselves. The proposed Victorian system provides payments only to households, and only for the surplus power fed back into the electricity grid after they have used what they need.

Mr Batchelor would not be interviewed yesterday, nor would he respond to questions of whether he stood by his $100 figure or how he arrived at it. Instead, spokeswoman Emma Tyner said the Government had "one of the most generous feed-in tariff schemes in Australia" which "ensures no vulnerable families are left behind". She said the gross model was "unfair".

Ms Tyner said the Government pursued policies that promoted large-scale renewable energy investments, including $50 million for the demonstration solar energy station near Mildura, the largest in the world. "Now the Federal Government has announced its emissions trading scheme, the CPRS will be the mechanism to reduce greenhouse gas emissions, and together with the renewable energy target, they will stimulate the most cost effective forms of renewable energy," she said.

Wednesday 28/1/2009 Page: 1

AN AMBITIOUS solar energy subsidy system - rejected as too expensive and "unfair" by the Brumby Government - would have cost Victorian households no more than 70 cents a week, according to confidential advice obtained by The Age. The system has been credited with triggering a multibillion dollar solar energy boom in Germany and has been adopted in about 40 other countries.

But despite repeated urgings from bureaucrats and government agencies to have the system adopted in Victoria as an affordable way of boosting renewable energy production, the Government rejected it in favour of a much less ambitious alternative. According to a leaked cabinet committee submission from the Department of Sustainability and Environment, the so called "gross feed-in" solar subsidy scheme would have cost households just $18 a year, or 35 cents a week, increasing electricity bills by just 2%.

The department's submission, seen by The Age, says the system would "provide the required momentum to create a thriving solar industry in Victoria". Instead, the Government chose to take the advice of one department, Primary Industries and Energy, for a cheaper model known as a "net feed-in tariff" - despite its costings showing the more generous scheme likely to cost Victorian households $37 a year or 70 cents a week.

The adopted scheme - to be detailed in Parliament within weeks - is widely viewed by academic and industry experts as unlikely to encourage a broad take-up of solar panels. Well-placed sources across government have told The Age that, until shortly before last year's cabinet decision, Premier John Brumby had been relaxed about the most ambitious scheme, and that it was also strongly backed by Environment Minister Gavin Jennings.

Then, after months of studies, consultant reports, debate and advice, Energy Minister Peter Batchelor produced his own last-minute figures, claiming the cost at $100 a year for households, or 10% on average power bills. He said it would be unfair to impose such a burden on low income households. Mr Batchelor told a public accounts committee hearing that the level of cross-subsidy from non-solar households to those with solar was unsupportable.

The "gross feed-in" system has adopted by more than 40 countries and is credited with fuelling Germany's solar industry, which employs 57,000 people and exports solar products worth $2 billion euros a year.

Under the German system, households, businesses, farmers and community groups receive subsidies for all the renewable power they generate, including what they use themselves. The proposed Victorian system provides payments only to households, and only for the surplus power fed back into the electricity grid after they have used what they need.

Mr Batchelor would not be interviewed yesterday, nor would he respond to questions of whether he stood by his $100 figure or how he arrived at it. Instead, spokeswoman Emma Tyner said the Government had "one of the most generous feed-in tariff schemes in Australia" which "ensures no vulnerable families are left behind". She said the gross model was "unfair".

Ms Tyner said the Government pursued policies that promoted large-scale renewable energy investments, including $50 million for the demonstration solar energy station near Mildura, the largest in the world. "Now the Federal Government has announced its emissions trading scheme, the CPRS will be the mechanism to reduce greenhouse gas emissions, and together with the renewable energy target, they will stimulate the most cost effective forms of renewable energy," she said.

Wednesday, 28 January 2009

Eco homes to give dirty industries a free ride

Sydney Morning Herald

Monday 26/1/2009 Page:6

A QUlRK in the Federal Government's proposed carbon-trading scheme means household efforts to cut carbon footprints could simply translate into more money in the pockets of heavy polluters, many economists and environment groups believe. If people use less coal-fired electricity at home, power companies will need to buy fewer carbon permits when the scheme starts in 2010.

A QUlRK in the Federal Government's proposed carbon-trading scheme means household efforts to cut carbon footprints could simply translate into more money in the pockets of heavy polluters, many economists and environment groups believe. If people use less coal-fired electricity at home, power companies will need to buy fewer carbon permits when the scheme starts in 2010.

This will reduce the permit price, allowing other polluters to buy more permits to cover their own emissions. One in 10 Australian households pays extra on the electricity bill to support green power, and tens of thousands have installed solar panels. But there is a growing realisation that voluntary efforts to reduce greenhouse gases may not have the intended effect. Paying $4000, after rebates, for a rooftop solar panel would reduce Australia's total carbon dioxide emissions, but it would mean a householder voluntarily bearing costs that industry would otherwise be forced to pay.

The director of the Total Environment Centre, Jeff Angel, said: "Unless the government guarantees that voluntary reductions are additional to Australia's compliance targets, well-meaning consumers will merely be enabling dirty industries to pollute more for free." If household energy reductions were not treated separately from industry emissions, people would no longer have a way to participate in adaption to climate change, he said. "While reducing individual emissions buys a clean conscience ... understandably most people wouldn't bother."

Voluntary carbon reductions could go a long way towards meeting the Government's greenhouse target of a 5% cut by 2020, said Chris Dunstan, a senior research consultant at the University of Technology's Institute for Sustainable Futures. "Given we've got the 5% target, it's entirely possible that voluntary action by households and businesses both through buying green power and through energy efficiency could easily provide another 5% cut."

The latest figures, for last year, showed 194,464 homes and 12,623 businesses across NSW had signed up for higher electricity bills in return for reducing their carbon output via wind or solar energy, a jump of nearly 50% on the previous year. The solution would be to allow people to retire a carbon permit when they had abated a tonne of greenhouse gas at home, Mr Dunstan said. "It's relatively straightforward, and I'd be surprised if the Government didn't do that."

The emissions trading scheme has yet to be finalised -legislation will be put forward this year - but plans contained in the government's white paper suggest the loophole remains open. A spokeswoman for the Climate Change Minister, Penny Wong, said that winding back the number of permits, so Australia could meet its carbon reduction targets, would allow for voluntary household reductions.

"The Government will be delivering energy efficiency measures for households prior to the commencement of the scheme in 2010," the spokeswoman said. "Everyone will be doing their bit under the carbon pollution reduction scheme; noone gets a free ride. Households will benefit directly from reducing their own carbon pollution through reduced energy bills." The number of the permits in the system under the carbon pollution reduction scheme would reduce over time, she said. Wolfgang SpraIz had a solar panel system put on the roof of his Undercliffe home last year.

"I personally want to make a contribution because I believe we should be making a much smaller footprint on the Earth, but I'm not sure if the broader community would feel that way if any emissions reduction they make isn't accounted for. "I think the burden should be shared more equally between industry and individual households."

Monday 26/1/2009 Page:6

A QUlRK in the Federal Government's proposed carbon-trading scheme means household efforts to cut carbon footprints could simply translate into more money in the pockets of heavy polluters, many economists and environment groups believe. If people use less coal-fired electricity at home, power companies will need to buy fewer carbon permits when the scheme starts in 2010.

A QUlRK in the Federal Government's proposed carbon-trading scheme means household efforts to cut carbon footprints could simply translate into more money in the pockets of heavy polluters, many economists and environment groups believe. If people use less coal-fired electricity at home, power companies will need to buy fewer carbon permits when the scheme starts in 2010.This will reduce the permit price, allowing other polluters to buy more permits to cover their own emissions. One in 10 Australian households pays extra on the electricity bill to support green power, and tens of thousands have installed solar panels. But there is a growing realisation that voluntary efforts to reduce greenhouse gases may not have the intended effect. Paying $4000, after rebates, for a rooftop solar panel would reduce Australia's total carbon dioxide emissions, but it would mean a householder voluntarily bearing costs that industry would otherwise be forced to pay.

The director of the Total Environment Centre, Jeff Angel, said: "Unless the government guarantees that voluntary reductions are additional to Australia's compliance targets, well-meaning consumers will merely be enabling dirty industries to pollute more for free." If household energy reductions were not treated separately from industry emissions, people would no longer have a way to participate in adaption to climate change, he said. "While reducing individual emissions buys a clean conscience ... understandably most people wouldn't bother."

Voluntary carbon reductions could go a long way towards meeting the Government's greenhouse target of a 5% cut by 2020, said Chris Dunstan, a senior research consultant at the University of Technology's Institute for Sustainable Futures. "Given we've got the 5% target, it's entirely possible that voluntary action by households and businesses both through buying green power and through energy efficiency could easily provide another 5% cut."

The latest figures, for last year, showed 194,464 homes and 12,623 businesses across NSW had signed up for higher electricity bills in return for reducing their carbon output via wind or solar energy, a jump of nearly 50% on the previous year. The solution would be to allow people to retire a carbon permit when they had abated a tonne of greenhouse gas at home, Mr Dunstan said. "It's relatively straightforward, and I'd be surprised if the Government didn't do that."

The emissions trading scheme has yet to be finalised -legislation will be put forward this year - but plans contained in the government's white paper suggest the loophole remains open. A spokeswoman for the Climate Change Minister, Penny Wong, said that winding back the number of permits, so Australia could meet its carbon reduction targets, would allow for voluntary household reductions.

"The Government will be delivering energy efficiency measures for households prior to the commencement of the scheme in 2010," the spokeswoman said. "Everyone will be doing their bit under the carbon pollution reduction scheme; noone gets a free ride. Households will benefit directly from reducing their own carbon pollution through reduced energy bills." The number of the permits in the system under the carbon pollution reduction scheme would reduce over time, she said. Wolfgang SpraIz had a solar panel system put on the roof of his Undercliffe home last year.

"I personally want to make a contribution because I believe we should be making a much smaller footprint on the Earth, but I'm not sure if the broader community would feel that way if any emissions reduction they make isn't accounted for. "I think the burden should be shared more equally between industry and individual households."

Solar cash vanishes as nation lags

Age

Tuesday 27/1/2009 Page: 1

AUSTRALIA is forfeiting billions of dollars in investment and thousands of jobs through its lack of support for solar energy, according to European companies that have shunned the sunburnt country. An Age investigation has found that potential investors courted by federal and state governments have rejected Australia, the world's sunniest continent, citing a lack of business incentives such as tax breaks and the nation's unwillingness to regulate in favour of renewable energy.

AUSTRALIA is forfeiting billions of dollars in investment and thousands of jobs through its lack of support for solar energy, according to European companies that have shunned the sunburnt country. An Age investigation has found that potential investors courted by federal and state governments have rejected Australia, the world's sunniest continent, citing a lack of business incentives such as tax breaks and the nation's unwillingness to regulate in favour of renewable energy.

Victorian cabinet committee documents obtained by The Age include a "commercial-in-confidence" list of predominantly European solar firms supposedly interested in Victoria. The 2008 cabinet submission says that with appropriate support, Victoria alone could attract solar investment worth $2.5 billion along with 2500 new jobs. The companies listed have since rejected advances from both the federal and state governments. Norwegian solar cell manufacturer UMOE tops the confidential list. Last year it combed the world in search of a home for an $800 million solar cell plant that would eventually employ 1300.

Drawn to Australia by its natural solar strengths, UMOE talked to a number of states and the federal investment aria Austrade about a location for its poly-silicon plant. But this month UMOE opted instead for cloudy Canada. Its renewables chief, Oystein Oyehaug, said: "In the 10 to 15 countries we visited we got substantially better packages than from Australia, whether it was tax or investment incentives or bank underwriting." He said the solar industry had been hopeful the Federal Government would embrace renewable energy. But the "key problem" for solar energy in Australia was the Government's "lack of a policy".

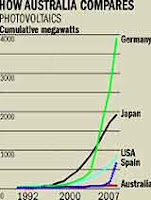

Mr Oyehaug said it was "amazing" that the Australian economy remained so reliant on old industry favourites such as coal and iron ore mining. "In the long term you should be doing More than mining for the Chinese," he said. However, Austrade said international interest in Australia's solar industry was growing as Labor implemented its energy and environmental policies and more investment was likely. Australia was among the world leaders in solar energy in the early 1990s, but it has fallen behind as Germany, Japan, Spain and California have invested heavily and/or regulated in favour of renewable energy.

While few doubt that solar energy will fare better under Prime Minister Kevin Rudd than his predecessor, John Howard, leaders from the renewables industry and the environment movement say they are disappointed with Labor's effort so far. The Government defended its record on encouraging renewable energy and solar in particular. Michael Bradley, a spokesman for Energy Minister Martin Ferguson, pointed to projects and programs such as the $500 million renewable energy fund, the $150 million energy innovation fund, and the $100 million Australian Solar Institute.

Mr Bradley said solar energy development would also benefit from the Government's target of producing 20% of all electricity from renewable sources by 2020, and the carbon pollution reduction scheme, which would make renewables more attractive. Germany's solar panel industry boomed in 2000 when the government introduced generous payments to solar producers. Western Australia and the ACT have embraced the German model but Queensland, South Australia and Victoria have adopted or are about to introduce, a watered-down version.

Mr Bradley said solar energy development would also benefit from the Government's target of producing 20% of all electricity from renewable sources by 2020, and the carbon pollution reduction scheme, which would make renewables more attractive. Germany's solar panel industry boomed in 2000 when the government introduced generous payments to solar producers. Western Australia and the ACT have embraced the German model but Queensland, South Australia and Victoria have adopted or are about to introduce, a watered-down version.

The Federal Government has not backed the more generous scheme. Another company on the Victorian list is German-based solar panel specialists Solon AG, which visited in December but has decided against investing. Sales director Ulrich Prochaska told The Age Australia was unlikely to build a substantial solar industry without providing a kicks tart. He said a German-style pricing system would trigger a solar "boom" in solar investment in Australia. Third on the international list is German solar panel manufacturer ALEO Solar.

Again, the company has chosen to invest elsewhere, this time in China. Spokesman Pascal Bertolone said it was "surprising" that Australia seemed unwilling to regulate in favour of renewables. The Victorian cabinet committee list also included Australian solar company Spark Solar as a possible investor in Victoria but Spark Solar is almost certain to establish its $70 million factory and 115 jobs in the ACT or NSW', as close as possible to the solar friendly ACT.

Mr Bradley would not comment directly on the Government's decision not to back a German-style tariff, instead stressing the importance of competition. "We need competition in the market so that the best and the most efficient technologies succeed," he said. While Australia has lagged on solar energy, it at least had countries with like-minded governments such as the Bush administration US for company. But it now risks being outshone even by the US, with new President Barack Obama declaring his aim of doubling renewable energy production in three years.

Tuesday 27/1/2009 Page: 1

AUSTRALIA is forfeiting billions of dollars in investment and thousands of jobs through its lack of support for solar energy, according to European companies that have shunned the sunburnt country. An Age investigation has found that potential investors courted by federal and state governments have rejected Australia, the world's sunniest continent, citing a lack of business incentives such as tax breaks and the nation's unwillingness to regulate in favour of renewable energy.

AUSTRALIA is forfeiting billions of dollars in investment and thousands of jobs through its lack of support for solar energy, according to European companies that have shunned the sunburnt country. An Age investigation has found that potential investors courted by federal and state governments have rejected Australia, the world's sunniest continent, citing a lack of business incentives such as tax breaks and the nation's unwillingness to regulate in favour of renewable energy.Victorian cabinet committee documents obtained by The Age include a "commercial-in-confidence" list of predominantly European solar firms supposedly interested in Victoria. The 2008 cabinet submission says that with appropriate support, Victoria alone could attract solar investment worth $2.5 billion along with 2500 new jobs. The companies listed have since rejected advances from both the federal and state governments. Norwegian solar cell manufacturer UMOE tops the confidential list. Last year it combed the world in search of a home for an $800 million solar cell plant that would eventually employ 1300.

Drawn to Australia by its natural solar strengths, UMOE talked to a number of states and the federal investment aria Austrade about a location for its poly-silicon plant. But this month UMOE opted instead for cloudy Canada. Its renewables chief, Oystein Oyehaug, said: "In the 10 to 15 countries we visited we got substantially better packages than from Australia, whether it was tax or investment incentives or bank underwriting." He said the solar industry had been hopeful the Federal Government would embrace renewable energy. But the "key problem" for solar energy in Australia was the Government's "lack of a policy".

Mr Oyehaug said it was "amazing" that the Australian economy remained so reliant on old industry favourites such as coal and iron ore mining. "In the long term you should be doing More than mining for the Chinese," he said. However, Austrade said international interest in Australia's solar industry was growing as Labor implemented its energy and environmental policies and more investment was likely. Australia was among the world leaders in solar energy in the early 1990s, but it has fallen behind as Germany, Japan, Spain and California have invested heavily and/or regulated in favour of renewable energy.

While few doubt that solar energy will fare better under Prime Minister Kevin Rudd than his predecessor, John Howard, leaders from the renewables industry and the environment movement say they are disappointed with Labor's effort so far. The Government defended its record on encouraging renewable energy and solar in particular. Michael Bradley, a spokesman for Energy Minister Martin Ferguson, pointed to projects and programs such as the $500 million renewable energy fund, the $150 million energy innovation fund, and the $100 million Australian Solar Institute.

Mr Bradley said solar energy development would also benefit from the Government's target of producing 20% of all electricity from renewable sources by 2020, and the carbon pollution reduction scheme, which would make renewables more attractive. Germany's solar panel industry boomed in 2000 when the government introduced generous payments to solar producers. Western Australia and the ACT have embraced the German model but Queensland, South Australia and Victoria have adopted or are about to introduce, a watered-down version.

Mr Bradley said solar energy development would also benefit from the Government's target of producing 20% of all electricity from renewable sources by 2020, and the carbon pollution reduction scheme, which would make renewables more attractive. Germany's solar panel industry boomed in 2000 when the government introduced generous payments to solar producers. Western Australia and the ACT have embraced the German model but Queensland, South Australia and Victoria have adopted or are about to introduce, a watered-down version.The Federal Government has not backed the more generous scheme. Another company on the Victorian list is German-based solar panel specialists Solon AG, which visited in December but has decided against investing. Sales director Ulrich Prochaska told The Age Australia was unlikely to build a substantial solar industry without providing a kicks tart. He said a German-style pricing system would trigger a solar "boom" in solar investment in Australia. Third on the international list is German solar panel manufacturer ALEO Solar.

Again, the company has chosen to invest elsewhere, this time in China. Spokesman Pascal Bertolone said it was "surprising" that Australia seemed unwilling to regulate in favour of renewables. The Victorian cabinet committee list also included Australian solar company Spark Solar as a possible investor in Victoria but Spark Solar is almost certain to establish its $70 million factory and 115 jobs in the ACT or NSW', as close as possible to the solar friendly ACT.

Mr Bradley would not comment directly on the Government's decision not to back a German-style tariff, instead stressing the importance of competition. "We need competition in the market so that the best and the most efficient technologies succeed," he said. While Australia has lagged on solar energy, it at least had countries with like-minded governments such as the Bush administration US for company. But it now risks being outshone even by the US, with new President Barack Obama declaring his aim of doubling renewable energy production in three years.

Solar firm puts money where its mouth is

Adelaide Advertiser

Tuesday 27/1/2009 Page: 49

AS part of the renewable energy sector, Solar SA couldn't just talk the talk when it came to their green credentials. General manager Rob Jung says it was important for the company to implement a range of environmental initiatives. "Because of the business we're in, it was critical we followed through ourselves," he said. Through a series of small operational changes, the business has achieved some significant environmental outcomes - and built some real green credentials.

AS part of the renewable energy sector, Solar SA couldn't just talk the talk when it came to their green credentials. General manager Rob Jung says it was important for the company to implement a range of environmental initiatives. "Because of the business we're in, it was critical we followed through ourselves," he said. Through a series of small operational changes, the business has achieved some significant environmental outcomes - and built some real green credentials.

The initiatives include down-sizing fleet cars, changing stationery to recycled paper, installing a recycling system to sort waste and turning off electrical equipment at night. "Adopting these initiatives has been quite cost-effective and will save us money in the long run," Mr Jung says. "It has also had a positive impact on staff and customer morale, knowing that we're doing our bit for the environment." Solar SA also plans to undergo a carbon audit in the near future, to properly measure its environmental impact and assess further improvements that could be made.

Tuesday 27/1/2009 Page: 49

AS part of the renewable energy sector, Solar SA couldn't just talk the talk when it came to their green credentials. General manager Rob Jung says it was important for the company to implement a range of environmental initiatives. "Because of the business we're in, it was critical we followed through ourselves," he said. Through a series of small operational changes, the business has achieved some significant environmental outcomes - and built some real green credentials.

AS part of the renewable energy sector, Solar SA couldn't just talk the talk when it came to their green credentials. General manager Rob Jung says it was important for the company to implement a range of environmental initiatives. "Because of the business we're in, it was critical we followed through ourselves," he said. Through a series of small operational changes, the business has achieved some significant environmental outcomes - and built some real green credentials.The initiatives include down-sizing fleet cars, changing stationery to recycled paper, installing a recycling system to sort waste and turning off electrical equipment at night. "Adopting these initiatives has been quite cost-effective and will save us money in the long run," Mr Jung says. "It has also had a positive impact on staff and customer morale, knowing that we're doing our bit for the environment." Solar SA also plans to undergo a carbon audit in the near future, to properly measure its environmental impact and assess further improvements that could be made.

Funds put firm on crest of bid to make wave power

Australian

Tuesday 27/1/2009 Page: 16

Perth renewable energy developer Carnegie Corporation has locked in funding for the final stage of commercial development of its wave technology, under an agreement with British partner Renewable Energy Holdings (REH). The announcement came just days after Carnegie Corporation signed a memorandum of understanding with the Australian Department of Defence to potentially build a wave farm to provide power and desalinated water to HMAS Stirling on Garden Island off the coast of Perth.

Carnegie Corporation, which is also backed by Electricite de France, one of the world's largest electricity producers, hopes to build the first commercial CETO (named after a Greek sea goddess) wave power energy station next year for about $400 million. The industrial scale power station would generate 50 MWs of electricity a year, enough for 30,000 households, managing director Mike Ottaviano said.

"We'll generate electricity at around about the cost of a wind farm. We'll be more expensive than coal and gas, the same price as wind and cheaper than solar," he said. The first one will be the most expensive but we'd expect within three to five years to be fossil fuel competitive." The zero-emission wave technology concept was conceived by Perth offshore oil and gas expert Alan Burns.

It involves suspending buoys below the water's surface above pumps that use the motion of the ocean to drive high-pressure sea water along pipes to an onshore hydro-electric style electricity plant onshore. "Our approach is radically different," Mr Ottaviano said. "What everyone has done in the past is try to build a floating power station very large concrete and steel structures that bob up and down and harness that movement to generate electricity, which is sent over long subsea high-voltage cables into the grid.

"But the worst place to generate electricity is the middle of the ocean the mix of electricity and water is typically not a good one." Challenges include the high maintenance that sophisticated and delicate generating equipment attracts when its sent out to sea. The other obstacle that wave energy developers have faced is the waves themselves. "There's been a litany of disasters in the wave energy space of people launching wave energy prototypes and then, within a week or a month, these prototypes sinking because they've been hit by a large wave," Mr Ottaviano said.

Carnegie Corporation's technology was the only fully submerged technology of its type in the world. '' It never sees a breaking wave and there's no aesthetic impact," Mr Ottaviano said. Mr Ottaviano said Carnegie Corporation had "zero debt" as well as cash to get through the year. Despite the group's share price taking a "hammering", sliding from 30c to around 11c, Mr Ottaviano said he was optimistic about the clean energy sector's resilience.

Tuesday 27/1/2009 Page: 16

Perth renewable energy developer Carnegie Corporation has locked in funding for the final stage of commercial development of its wave technology, under an agreement with British partner Renewable Energy Holdings (REH). The announcement came just days after Carnegie Corporation signed a memorandum of understanding with the Australian Department of Defence to potentially build a wave farm to provide power and desalinated water to HMAS Stirling on Garden Island off the coast of Perth.

Carnegie Corporation, which is also backed by Electricite de France, one of the world's largest electricity producers, hopes to build the first commercial CETO (named after a Greek sea goddess) wave power energy station next year for about $400 million. The industrial scale power station would generate 50 MWs of electricity a year, enough for 30,000 households, managing director Mike Ottaviano said.

"We'll generate electricity at around about the cost of a wind farm. We'll be more expensive than coal and gas, the same price as wind and cheaper than solar," he said. The first one will be the most expensive but we'd expect within three to five years to be fossil fuel competitive." The zero-emission wave technology concept was conceived by Perth offshore oil and gas expert Alan Burns.

It involves suspending buoys below the water's surface above pumps that use the motion of the ocean to drive high-pressure sea water along pipes to an onshore hydro-electric style electricity plant onshore. "Our approach is radically different," Mr Ottaviano said. "What everyone has done in the past is try to build a floating power station very large concrete and steel structures that bob up and down and harness that movement to generate electricity, which is sent over long subsea high-voltage cables into the grid.

"But the worst place to generate electricity is the middle of the ocean the mix of electricity and water is typically not a good one." Challenges include the high maintenance that sophisticated and delicate generating equipment attracts when its sent out to sea. The other obstacle that wave energy developers have faced is the waves themselves. "There's been a litany of disasters in the wave energy space of people launching wave energy prototypes and then, within a week or a month, these prototypes sinking because they've been hit by a large wave," Mr Ottaviano said.

Carnegie Corporation's technology was the only fully submerged technology of its type in the world. '' It never sees a breaking wave and there's no aesthetic impact," Mr Ottaviano said. Mr Ottaviano said Carnegie Corporation had "zero debt" as well as cash to get through the year. Despite the group's share price taking a "hammering", sliding from 30c to around 11c, Mr Ottaviano said he was optimistic about the clean energy sector's resilience.

Energy deals ran out of gas last year

Australian

Tuesday 27/1/2009 Page: 16

UNCERTAINTY over the federal Government's planned emissions trading scheme and the global economic crisis nearly brought Australian power deals to a halt last year, according to a report to be released today. Australian electricity and gas mergers and acquisitions fell from $US19 billion ($29 billion) in 2007, when it led the Asia-Pacific region in power deals, to $US1.75 billion last year, PricewaterhouseCoopers says.

"Power deals in Australia, which had previously been a main motor of growing merger and acquisition activity in the Asia-Pacific region, virtually stalled, as uncertainty over new carbon emission policies combined with the financial crisis to deter deal flow," said Manfred Wiegand, PwC's head of global utilities. The wave of consolidation in Queensland's burgeoning coal seam gas industry, which saw more than $20 billion in cash change hands last year, was not included by PwC in its figures.

But it did refer to Origin Energy's defence of BG Group's $15 billion bid as evidence of companies holding on to gas assets. PwC's head of resources in Australia, Michael Happell, said the stalling of NSW plans to sell electricity assets also meant fewer deals went through last year, but that 2009 should see a pick-up in activity. "The NSW Government's power privatisation plans, as well as Babcock and Brown Power's intended disposal of its national energy portfolio will significantly alter the ownership in 2009," he said.

But gas asset sales could be excluded from activity, as potential sellers try to see out the current economic crisis. "Many owners of gas assets have strong cash flows and are choosing not to sell in the current environment," Mr Happell said. A PwC spokesman said the absence of BG Group's $5.3 billion takeover of Queensland Gas was because it had just missed the deadline to be included in the report.

He said the multi-billion dollar deals done by ConocoPhillips and Petronas to gain stakes in reserves and liquefied natural gas projects, which were finalised during the year, were left out because they were upstream deals, unlike the QGC and Origin Energy deals, which also contained power assets. Internationally, power and gas transactions plunged from $372.5 billion to $US205.6 billion, while transaction volumes rose. The biggest deal of 2008 was Gas Natural's $US35.9 billion takeover of Spanish compatriot Union Fenosa.

Tuesday 27/1/2009 Page: 16

UNCERTAINTY over the federal Government's planned emissions trading scheme and the global economic crisis nearly brought Australian power deals to a halt last year, according to a report to be released today. Australian electricity and gas mergers and acquisitions fell from $US19 billion ($29 billion) in 2007, when it led the Asia-Pacific region in power deals, to $US1.75 billion last year, PricewaterhouseCoopers says.

"Power deals in Australia, which had previously been a main motor of growing merger and acquisition activity in the Asia-Pacific region, virtually stalled, as uncertainty over new carbon emission policies combined with the financial crisis to deter deal flow," said Manfred Wiegand, PwC's head of global utilities. The wave of consolidation in Queensland's burgeoning coal seam gas industry, which saw more than $20 billion in cash change hands last year, was not included by PwC in its figures.

But it did refer to Origin Energy's defence of BG Group's $15 billion bid as evidence of companies holding on to gas assets. PwC's head of resources in Australia, Michael Happell, said the stalling of NSW plans to sell electricity assets also meant fewer deals went through last year, but that 2009 should see a pick-up in activity. "The NSW Government's power privatisation plans, as well as Babcock and Brown Power's intended disposal of its national energy portfolio will significantly alter the ownership in 2009," he said.

But gas asset sales could be excluded from activity, as potential sellers try to see out the current economic crisis. "Many owners of gas assets have strong cash flows and are choosing not to sell in the current environment," Mr Happell said. A PwC spokesman said the absence of BG Group's $5.3 billion takeover of Queensland Gas was because it had just missed the deadline to be included in the report.

He said the multi-billion dollar deals done by ConocoPhillips and Petronas to gain stakes in reserves and liquefied natural gas projects, which were finalised during the year, were left out because they were upstream deals, unlike the QGC and Origin Energy deals, which also contained power assets. Internationally, power and gas transactions plunged from $372.5 billion to $US205.6 billion, while transaction volumes rose. The biggest deal of 2008 was Gas Natural's $US35.9 billion takeover of Spanish compatriot Union Fenosa.

Energy deals ran out of gas last year

Australian

Tuesday 27/1/2009 Page: 16

UNCERTAINTY over the federal Government's planned emissions trading scheme and the global economic crisis nearly brought Australian power deals to a halt last year, according to a report to be released today. Australian electricity and gas mergers and acquisitions fell from $US19 billion ($29 billion) in 2007, when it led the Asia-Pacific region in power deals, to $US1.75 billion last year, PricewaterhouseCoopers says.

"Power deals in Australia, which had previously been a main motor of growing merger and acquisition activity in the Asia-Pacific region, virtually stalled, as uncertainty over new carbon emission policies combined with the financial crisis to deter deal flow," said Manfred Wiegand, PwC's head of global utilities. The wave of consolidation in Queensland's burgeoning coal seam gas industry, which saw more than $20 billion in cash change hands last year, was not included by PwC in its figures.

But it did refer to Origin Energy's defence of BG Group's $15 billion bid as evidence of companies holding on to gas assets. PwC's head of resources in Australia, Michael Happell, said the stalling of NSW plans to sell electricity assets also meant fewer deals went through last year, but that 2009 should see a pick-up in activity. "The NSW Government's power privatisation plans, as well as Babcock and Brown Power's intended disposal of its national energy portfolio will significantly alter the ownership in 2009," he said.

But gas asset sales could be excluded from activity, as potential sellers try to see out the current economic crisis. "Many owners of gas assets have strong cash flows and are choosing not to sell in the current environment," Mr Happell said. A PwC spokesman said the absence of BG Group's $5.3 billion takeover of Queensland Gas was because it had just missed the deadline to be included in the report.

He said the multi-billion dollar deals done by ConocoPhillips and Petronas to gain stakes in reserves and liquefied natural gas projects, which were finalised during the year, were left out because they were upstream deals, unlike the QGC and Origin Energy deals, which also contained power assets. Internationally, power and gas transactions plunged from $372.5 billion to $US205.6 billion, while transaction volumes rose. The biggest deal of 2008 was Gas Natural's $US35.9 billion takeover of Spanish compatriot Union Fenosa.

Tuesday 27/1/2009 Page: 16

UNCERTAINTY over the federal Government's planned emissions trading scheme and the global economic crisis nearly brought Australian power deals to a halt last year, according to a report to be released today. Australian electricity and gas mergers and acquisitions fell from $US19 billion ($29 billion) in 2007, when it led the Asia-Pacific region in power deals, to $US1.75 billion last year, PricewaterhouseCoopers says.

"Power deals in Australia, which had previously been a main motor of growing merger and acquisition activity in the Asia-Pacific region, virtually stalled, as uncertainty over new carbon emission policies combined with the financial crisis to deter deal flow," said Manfred Wiegand, PwC's head of global utilities. The wave of consolidation in Queensland's burgeoning coal seam gas industry, which saw more than $20 billion in cash change hands last year, was not included by PwC in its figures.

But it did refer to Origin Energy's defence of BG Group's $15 billion bid as evidence of companies holding on to gas assets. PwC's head of resources in Australia, Michael Happell, said the stalling of NSW plans to sell electricity assets also meant fewer deals went through last year, but that 2009 should see a pick-up in activity. "The NSW Government's power privatisation plans, as well as Babcock and Brown Power's intended disposal of its national energy portfolio will significantly alter the ownership in 2009," he said.

But gas asset sales could be excluded from activity, as potential sellers try to see out the current economic crisis. "Many owners of gas assets have strong cash flows and are choosing not to sell in the current environment," Mr Happell said. A PwC spokesman said the absence of BG Group's $5.3 billion takeover of Queensland Gas was because it had just missed the deadline to be included in the report.

He said the multi-billion dollar deals done by ConocoPhillips and Petronas to gain stakes in reserves and liquefied natural gas projects, which were finalised during the year, were left out because they were upstream deals, unlike the QGC and Origin Energy deals, which also contained power assets. Internationally, power and gas transactions plunged from $372.5 billion to $US205.6 billion, while transaction volumes rose. The biggest deal of 2008 was Gas Natural's $US35.9 billion takeover of Spanish compatriot Union Fenosa.

Solar hot shot poised to plug Australia into the sun

Age

Tuesday 27/1/2009 Page: 4

WITH marble-lined corridors and the steepest office rents in Melbourne, 101 Collins Street's tenants are mostly corporate giants such as Macquarie Bank. But the new kid on the block, solar manufacturer Ausra Australia, already feels at home beside its bigger neighbours. This year, the local branch of the US-based company is preparing to announce new deals worth more than $1 billion to build large solar energy plants in at least two Australian states.

Its solar thermal power technology - first developed in New South Wales, and capable of generating electricity on an industrial scale for much less than the cost of traditional photovoltaic panels - is now in hot demand. "We've been working with state and federal governments very closely in the last six to nine months in particular, as well as the mining industry, which is leading the way in interest in off-grid applications," Ausra Australia chief executive Bob Matthews said. "We will have deals (to announce) this year for certain.

It's very difficult to tell you where they are, but they're in two different states and they are very large projects." One of those power plants is likely to use a combination of solar thermal and gas to provide 24-hour baseload electricity to power a remote mining operation. The other is likely to feed extra power into the national electricity grid. But despite his optimistic outlook, Mr Matthews agreed with other solar experts in calling for stronger national policies in Australia, particularly a gross feed-in tariff and loan guarantees, which are driving new investment in countries such as Germany and the United States.

"That's what they're doing elsewhere in the world and that's what really needs to happen here too," he said. Last year, Ausra opened a solar thermal manufacturing factory in Las Vegas and a small-scale power plant in the desert north of Los Angeles. It is now preparing to build a larger 177-MW power plant in central California, able to power 120,000 homes - roughly the equivalent of powering Canberra. It has attracted some high-profile fans, including Californian Governor Arnold Schwarzenegger, who has called Ausra "one of the best companies in California and the world".

It's a great Australian success story. Yet it only happened after its founder, former Sydney University professor David Mills, got so frustrated with successive federal governments' anti-renewables policies that he moved to California's Silicon Valley two years ago to set up Ausra's headquarters there. Ausra's history reflects an ongoing brain drain of Australian solar expertise to countries with long-term investment policies for renewable energy. Among the experts who have been forced to take their technology offshore are former University of New South Wales student Dr Zhengrong Shi, who became China's first solar billionaire, as well as Dr Shi's former professor, Martin Green, whose award-winning thin-film solar panels are now manufactured in Germany.

Tuesday 27/1/2009 Page: 4

WITH marble-lined corridors and the steepest office rents in Melbourne, 101 Collins Street's tenants are mostly corporate giants such as Macquarie Bank. But the new kid on the block, solar manufacturer Ausra Australia, already feels at home beside its bigger neighbours. This year, the local branch of the US-based company is preparing to announce new deals worth more than $1 billion to build large solar energy plants in at least two Australian states.

Its solar thermal power technology - first developed in New South Wales, and capable of generating electricity on an industrial scale for much less than the cost of traditional photovoltaic panels - is now in hot demand. "We've been working with state and federal governments very closely in the last six to nine months in particular, as well as the mining industry, which is leading the way in interest in off-grid applications," Ausra Australia chief executive Bob Matthews said. "We will have deals (to announce) this year for certain.

It's very difficult to tell you where they are, but they're in two different states and they are very large projects." One of those power plants is likely to use a combination of solar thermal and gas to provide 24-hour baseload electricity to power a remote mining operation. The other is likely to feed extra power into the national electricity grid. But despite his optimistic outlook, Mr Matthews agreed with other solar experts in calling for stronger national policies in Australia, particularly a gross feed-in tariff and loan guarantees, which are driving new investment in countries such as Germany and the United States.

"That's what they're doing elsewhere in the world and that's what really needs to happen here too," he said. Last year, Ausra opened a solar thermal manufacturing factory in Las Vegas and a small-scale power plant in the desert north of Los Angeles. It is now preparing to build a larger 177-MW power plant in central California, able to power 120,000 homes - roughly the equivalent of powering Canberra. It has attracted some high-profile fans, including Californian Governor Arnold Schwarzenegger, who has called Ausra "one of the best companies in California and the world".

It's a great Australian success story. Yet it only happened after its founder, former Sydney University professor David Mills, got so frustrated with successive federal governments' anti-renewables policies that he moved to California's Silicon Valley two years ago to set up Ausra's headquarters there. Ausra's history reflects an ongoing brain drain of Australian solar expertise to countries with long-term investment policies for renewable energy. Among the experts who have been forced to take their technology offshore are former University of New South Wales student Dr Zhengrong Shi, who became China's first solar billionaire, as well as Dr Shi's former professor, Martin Green, whose award-winning thin-film solar panels are now manufactured in Germany.

Tuesday, 27 January 2009

US stimulus package proposes $54 billion clean energy spend

www.environmental-finance.com/

New York, 22 January:

The economic stimulus package being considered by the US House of Representatives features sizeable investments in clean energy projects and infrastructure that could boost the sector. Backing up President Barack Obama's pledge to double renewable energy production within three years, the House proposed last Thursday an $825 billion package, with $54 billion dedicated to developing the sector and improving US energy efficiency.

The American Recovery and Reinvestment Act of 2009 devotes $11 billion for research and development, pilot projects and federal matching funds to modernise the electricity grid by making it more efficient, secure and reliable, and building new power lines to transmit renewable energy from large-scale production areas to population centres.

"It's really interesting that [Obama] is going for core, high-tech improvements," said Donna Attanasio, a partner in the energy, infrastructure and project finance group of law firm White & Case in Washington, DC. "It's a smart approach. He's really looking at ways to improve the industry and putting some money into it." Despite the funding, major challenges remain to the development of a smart grid, including ensuring that any upgrades are performed in a manner that does not disrupt or damage the grid and securing necessary state approvals, she said.

Loans totalling $8 billion would fund renewable energy power generation and transmission projects, a direct response to the contraction in the credit markets and lower bond ratings that have postponed new projects. In addition, $2 billion would be spent on energy efficiency and renewable energy research, development and deployment projects, including $800 million devoted to biomass projects and $400 million for geothermal activities and projects.

The $54 billion also includes $2.4 billion for carbon capture and sequestration technology demonstration projects that aim to reduce the amount of carbon dioxide emitted from industrial facilities and fossil fuel power plants. "That certainly is a start," said a spokesman for the Edison Electric Institute, an association of US shareholder-owned utilities. "What we'll need ultimately to reach commercialisation of advanced coal is steady funding over several years that is not subject to appropriations."

The full House has yet to consider the bill while the Senate is expected to debate its version over the next few weeks, so the funding figures are likely to change. Congressional leaders hope to have a bill ready for Obama's signature by mid-February. "It's exciting that it's in the economic stimulus package because you know it's going to move," Attanasio said.

New York, 22 January:

The economic stimulus package being considered by the US House of Representatives features sizeable investments in clean energy projects and infrastructure that could boost the sector. Backing up President Barack Obama's pledge to double renewable energy production within three years, the House proposed last Thursday an $825 billion package, with $54 billion dedicated to developing the sector and improving US energy efficiency.

The American Recovery and Reinvestment Act of 2009 devotes $11 billion for research and development, pilot projects and federal matching funds to modernise the electricity grid by making it more efficient, secure and reliable, and building new power lines to transmit renewable energy from large-scale production areas to population centres.

"It's really interesting that [Obama] is going for core, high-tech improvements," said Donna Attanasio, a partner in the energy, infrastructure and project finance group of law firm White & Case in Washington, DC. "It's a smart approach. He's really looking at ways to improve the industry and putting some money into it." Despite the funding, major challenges remain to the development of a smart grid, including ensuring that any upgrades are performed in a manner that does not disrupt or damage the grid and securing necessary state approvals, she said.

Loans totalling $8 billion would fund renewable energy power generation and transmission projects, a direct response to the contraction in the credit markets and lower bond ratings that have postponed new projects. In addition, $2 billion would be spent on energy efficiency and renewable energy research, development and deployment projects, including $800 million devoted to biomass projects and $400 million for geothermal activities and projects.